BPD/103/155/01

15th July 2025

- I wish to welcome the media and other stakeholders to this press briefing whose objective is to:

- Brief the country on the State of the Economy;

- Communicate to the country the release of funds to Government Institutions for the First Quarter (Q1) of FY 2025/26; and,

- Provide guidance to Accounting Officers on execution of the Budget.

- Let me start by summarising the State of Economy.

- STATE OF THE ECONOMY

Economic Growth

- The economy is continuing to exhibit resilience and sustained growth in spite of the global uncertainties like trade wars, international conflicts among others. Growth averaged 6.9% in the first three quarters of the just concluded Financial Year. This robust growth in GDP was on account of Government expenditure in PDM, growth in fixed capital formation, and recovery in household expenditure. There was also growth in investments and exports. The good performance of the economy is expected to continue in FY 2025/26. Real GDP growth is projected at 7% this FY 2025/26 and is expected to reach double digits in the medium term.

- In nominal terms, the size of the economy increased to Shs. 226.34 trillion (USD 61.3 billion) in FY 2024/25, from Shs. 203.71 trillion (USD 53.9 billion) registered in FY 2023/24.

- High-frequency indicators of economic activity have continued to show improvements in the performance of the economy. In the fourth quarter of FY 2024/25, the Purchasing Managers’ Index (PMI), which indicates business operating conditions, stood at 55.6. The the Composite Index of Economic Activity (CIEA), which monitors economic trends, was 178.58, while the Business Tendency Index, which provides insights into overall business climate was recorded at 59.17 in June 2025.

Inflation and Exchange rate

- Annual headline inflation remained subdued and within the policy target of 5%. Inflation was recorded at 3.9% in June 2025, a slight increase from the 3.8% recorded in May 2025.

- The Uganda Shilling has continued to strengthen against the US Dollar. During the month of June 2025, the shilling appreciated by 1.3% against the US Dollar. This was largely on account of improved export performance, increased remittances and offshore investments, as well as prudent macroeconomic management. The Shilling has remained one of the best performing currencies in Africa.

External Sector

- Uganda’s total export earning in Q3 of FY 2024/25 amounted to USD 2.6 billion. This translates to a growth of 39.1% compared to export earnings of USD 1.9 billion recorded for Q3 FY 2023/24. This was as a result of improved volumes and international prices of some export commodities such as coffee and cocoa which more than doubled between the two quarters. Total exports of goods and services for the 12 months to March 2025 was USD 11.8 billion from USD 9.56 billion for the same period in 2024.

- Similarly, the country’s import bill grew by 16.5% from USD 2.619 billion in Q3 of FY 2023/24 to USD 3.051 billion in Q3 of FY 2024/25. This was mainly driven by the formal non-oil private sector imports.

- Consequently, due to higher growth in exports compared to imports, Uganda’s trade deficit with the rest of the world narrowed by 39.1% to USD 461.15 million in Q3 of FY 2024/25 from USD 757.48 million in the same quarter of the previous financial year.

Foreign direct investment and remittances

- Remittances for Q3 of FY 2024/25 were USD 304.48 million compared to USD 231.68 million recorded for Q3 of FY 2023/24. This implies an increment of 31.4%. Total remittances from Ugandans living and working abroad were USD 1.4 billion 12 months to March 2025, compared to USD 1.33 billion in the same period in 2024.

- Uganda also continues to be a favourable destination for Foreign Direct Investment (FDI) in various sectors of the economy. In Q3 of FY 2024/25, FDI amounted to USD 785.79 million, a 26.3% increase from the USD 622.06 million registered in the same period of the previous year. Total foreign direct investments were worth USD 3.48 billion in twelve months to March 2025, compared to USD 2.99 billion during the same period in 2024.

- The Balance of Payments (BoP) is improving with declining current account deficit and improving international reserves which increased to USD 4.3 billion equivalent to 3.8 months of imports as at June 2025 from USD 3.2 billion in June 2024.

- BUDGET RELEASE FOR QUARTER ONE OF FY 2025/26

- The approved Budget for FY 2025/26 amounted to Shs 72.376 trillion as summarized below:

Table 1: Breakdown of the Approved Budget for FY 2025/26

| Category | Amount (Shs trillion) | |

| Wage | 8.56 | |

| Non-Wage | 16.12 | |

| GoU Development | 6.91 | |

| External Financing – Dev’t | 11.32 | |

| Debt and Treasury Operations | 27.72 | |

| Arrears | 1.40 | |

| Local Revenue | 0.33 | |

| Total Budget | 72.38 |

- Out of the Shs. 72.38 trillion for FY 2025/26, the budget available to finance activities, after taking care of all debts including domestic arrears is Shs 43.4 trillion.

- HIGHLIGHTS OF EXPENDITURE LIMITS FOR THE FIRST QUARTER OF FY 2025/26

- The Quarter One (July – September 2025), expenditure limits released amount to Shs 17.18 trillion. Thisrepresents a release of 23.7% of the approved budget, which is broken down as follows:

Table 2: FY 2025/26 Quarter one Expenditure Limits released

| Category | Q1 Release (Shs billion) | % of Approved budget |

| Wage | 2,261.60 | 26.4% |

| Non-Wage | 4,496.46 | 27.9% |

| GoU Development | 692.88 | 10.0% |

| External Financing – Dev’t | 2,717.59 | 24.0% |

| Debt & Treasury Operations | 6,929.11 | 25.0% |

| Local Revenue | 82.17 | 25.0% |

| Total | 17,179.81 | 23.7% |

- The key highlights of the Q1 release per category are as follows:

Statutory Obligations and Institutions

- Shs 2.261 trillion to cater for wages and salaries across Government;

- Shs 482.76 billion for Pension and Gratuity;

- Parliament – Shs 249.38 billion;

- Electoral Commission – Shs 468.72 billion;

- Judiciary – Shs 47.37 billion;

- Auditor General – Shs 19.14 billion;

- National Planning Authority – Shs 53.72 billion

ATMS to drive tenfold growth

- Agro-industrialization (A) – Shs 215.28 billion. Of this, Shs 62.41 billion is for research and operations of institutions within the programme while Shs 152.86 billion is for development projects;

- Tourism development (T) – Shs 20.5 billion has been released to Ministry of Tourism, Wildlife and Antiquities and Uganda Tourism Board. These funds are for financing tourism sector development interventions like branding and marketing, promoting and enforcing hospitality standards among others. This release excludes funds for Uganda Wildlife Authority (UWA) that retains funds at source;

- Mineral-Based Industrial Development including oil and gas (M) – Shs 26 billion of which Shs 19.5 billion is under the Ministry of Energy and Mineral Development and, Shs 6.5 billion under Petroleum Authority of Uganda. This does not include funds for Uganda National Oil Company (UNOC) which retains funds at source; and

- Science, Technology and Innovation including ICT and creatives industry – Shs 139.13 billion for development interventions under Science, Technology and innovation, Ministry of ICT and National Guidance and National Information Technologies Authority of Uganda (NITA-U). Of this, Shs 33 billion is for Artists under Ministry of Gender, Labour and Social Development and Shs 83.3 billion under Science, Technology and Innovation.

Enablers of the ATMS

Security

- Ministry of Defense and Veteran Affairs – Shs 719.12 billion;

- Uganda Police Force – Shs 130.73 billion;

- State House – Shs 108.38 billion;

- Uganda Prisons Service – Shs 87.15 billion;

- Office of the President – Shs 111.4 billion;

- ISO – Shs 39.2 billion; and

- ESO – Shs 86.9 billion.

Infrastructure

- Ministry of Works and Transport – Shs 1.076 trillion has been released. Of this, Shs 942.90 billion is for the payment of contractors for on-going works projects;

- Ministry of Energy and Mineral Development – Shs 420.76 billion. Of this, Shs 398.75 billion is to implement rural electrification projects, finance development of other transmission lines and power generation projects like Karuma and, funding to support activities for mineral development;

- Kampala Capital City Authority – Shs 148.32 billion for implementation of development projects within the city like roads, and drainage among others.

Human Capital Development

- Shs 143.75 billion has been releasedfor Ministry of Education and Sports. Shs 80.42 billion is to cater for the non-wage recurrent activities and Shs 63.33 billion for the implementation of the Uganda Secondary Education Expansion project (USEEP) and Uganda Learning Acceleration Project (ULEARN);

- Shs 157.73 billion has been released for all Public Universities, Uganda Management Institute and Law Development Centre in line with their requirements. Of this, Shs 16.49 billion is allocated to their capital development projects;

- Shs 262.88 billion forMinistry of Health.Of this, Shs 238.74 billion is for development purposes namely support planned health infrastructure development and implementation Global Alliance for Vaccines and Immunization (GAVI), Global Fund and Karamoja Infrastructure Development projects, and other outstanding contractual obligations;

- Shs 173.96 billion has been released to National Medical Stores (NMS) for the purchase of essential drugs and medicines.

- Shs 118.23 billion for Ministry of Gender, Labour and Social Development. Of this, Shs 83.64 billion is to cater for the operational budget as well as subventions under the Ministry including the Social Assistance Grants for Empowerment (SAGE) requirements.

- Shs 80.18 billion has been releasedunder Uganda Cancer Institute and Uganda Heart Institute. Of this, Shs 55.10 billion for contractual obligations and Shs 25.08 billion for their operations;

- Regional Referral hospitals including Mulago and Butabika Hospitals have been allocated Shs 40.99 billion, of which Shs 40 billion is for the non-wage recurrent budget;

- Local Governments – Shs 382.03 billion has been released. Of this, Shs 342.52 billion is for their operations and Shs 39.50 billion to cater for projects with contractual obligations.

Revenue Generating Votes

- Shs 114.90 billion under Uganda Revenue Authority to facilitate revenue collection;

- Shs 9.71 billion for Uganda Registration Services Bureau;

- Shs 40.43 billion has been allocated to National Citizenship and Immigration Control,

- Shs 26.44 billion for Uganda National Bureau of Standards.

CONCLUSION

- As I conclude, I would like to emphasize the following:

- The budget for this financial year is designed to support the implementation of the Ten-Fold Growth Strategy. Emphasis is towards the ATMS and the enablers. As government, our main objective is to promote technical efficiency by ensuring that all Ministries, Department, Agencies and Local Governments deliver better services to Ugandans at the lowest cost;

- All Accounting Officers are instructed to comply with the commitment to pay salaries, pensions and gratuity by the 28th day of every month as per the approved salary scales;

- In order to eliminate the accumulation of domestic arrears and penalties, Accounting Officers are directed to prioritize payment of service providers on time. Accounting Officers should stick to the requirement of not committing government without a sufficient budget;

- All Accounting Officers must ensure that all contracts and payments are executed in Uganda Shillings;

- NO recruitment should be done without clearance from the Ministry of Public Service after ascertaining availability of adequate wage from this Ministry;

- I urge Accounting Officers to convene Finance Committee Meetings to agree on the priorities for the quarter in line with the approved budget and resources available to inform allocations to cost centers.

p

- Once again, I wish to thank the Press and Civil Society for supporting our budget transparency initiative. I urge you to make use of our website www.budget.finance.go.ug where we post more detailed information. You may also call our Budget Call Centre on 0800 229 229 for any information on the Budget.

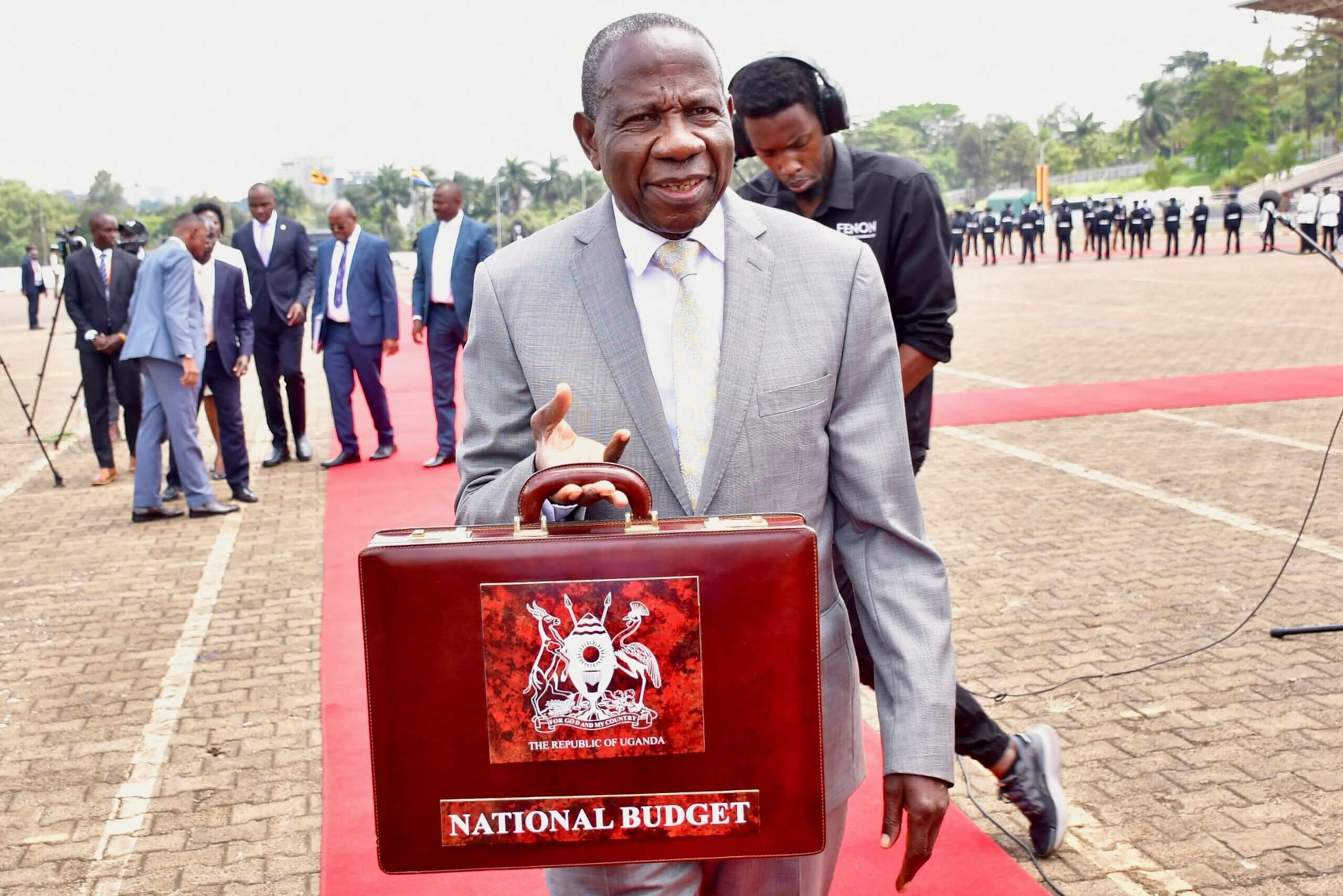

Ramathan Ggoobi

PERMANENT SECRETARY/ SECRETARY TO TREASURY